Insurance 101: Coverage Tips

Now that the holidays are over, it’s time to review your insurance policies and make necessary changes. Read your homeowners or renter’s policy and speak with your agent or insurer for a complete list of perils excluded and to purchase additional coverage you may need. Here are a few quick facts to get you started:

Fire. A typical policy will issue payment to replace or repair anything inside a home damaged by flames, smoke, soot and ash.

Explosions. A standard homeowners or rental policy will cover damage due to causes such as a gas leak.

Flood. Homeowners and renters insurance do not offer protection against flood losses. You should check your policy’s exclusions. It will probably be listed under “water damage”.

Tornadoes. A standard homeowner’s policy typically covers tornado damage. There is likely no need to purchase additional coverage.

Hurricanes. Damage caused by a windstorm or hail is usually covered. Flood or storm surge damage caused from a hurricane is not.

___________________________________________________________________________________

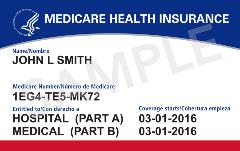

Attention Medicare Beneficiaries: New Cards

Our Senior Health Insurance Information Program (SHIIP) staff are working to make sure Medicare beneficiaries are on track to receive their new Medicare cards. The Centers for Medicare & Medicaid Services (CMS) will begin mailing the cards April 2018. Medicare recipients should make sure the Social Security Administration has their correct mailing address. If you need assistance, contact our SHIIP staff at 1-800-259-5300. Also, Senior Health Director Vicki Dufrene will have more information later this month during our Facebook Live series, Leave It to Vicki.

___________________________________________________________________________________

Take the Time to Shop Around

Begin the New Year with the proper insurance coverage to fit your budget. The Louisiana Department of Insurance encourages you to shop your rates. Hundreds of people use our online guides each month to compare their homeowners or automobile insurance rates among companies. The guides will not give you an exact estimate of the cost of your insurance but will show you sample rates and how they vary among companies.

When shopping for insurance, look for a company that is financially sound, has a history of good service and charges a fair rate. We provide complaint data online by type of insurance which can help you as you compare companies.

___________________________________________________________________________________

Coming Soon: Free Agent Workshop in Lafayette

Beginning January 1, there are changes in the license renewal schedule for insurance agents. Producers can learn more about these changes and earn continuing education credits at our next Business Building Blocks Workshop. The free event takes place February 15 at the Lite Center Theatre in Lafayette. The agenda includes an ethics presentation and a session on engaging your employees. For more information, contact our Division of Diversity and Opportunity at 225-219-4344. To register, click here.

___________________________________________________________________________________

Stay Connected with the LDI

Keep up with tips and news from the LDI, including newsletters, press releases and videos, by connecting with us through social media.

You can discontinue this communication by clicking {|MergeContextItems.UnsubscribeLink|}.